Are you looking to get property in the future? Racking your brains on different particular mortgages available? Challenging isn’t it?

Purchasing a home, whether or not to live in or just like the a residential property so you can book away, can be a lengthy procedure. Knowing the inches-and-outs of it often stretch the fresh restrictions out-of anyone’s studies and you may perseverance.

Understanding the difference in an enthusiastic FHA versus conventional loan is a good good initial step. Knowing what they are as well as how they are different, you could proceed with a little far more count on. You could fulfill the best mortgage with the financial predicament and perhaps even spend less in the process!

And this loan is right for you? Continue reading to learn more about a conventional financial versus FHA financial to determine what one to might be suitable for your.

The FHA Financing

![]()

Chairman Franklin D. Roosevelt depending the latest Government Homes Administration (FHA) from inside the 1934. It absolutely was an element of the Federal Houses Act and will be offering mortgages to possess solitary-family relations home and you may multifamily rental features.

FHA financing try supported, or guaranteed, because of the authorities. Meaning in the event the a holder non-payments towards financing, government entities pays the financial institution the bill of your own home loan.

Mortgages through the FHA was basically intended to help a great deal more lowest- and you may average-earnings some one pay for property. They have a tendency having fewer limits and lower certification restrictions. This might be utilized for somebody which have a decreased credit rating, large loans-to-money ratio, or somebody who doesn’t have a big downpayment offered.

The conventional Mortgage

A traditional financing is through a personal financial and isn’t really secured by bodies. You usually you want a higher credit rating and you may reduced financial obligation-to-earnings ratio to help you meet the requirements. Nonetheless they require that you keeps more substantial deposit.

Antique loans usually are bought of the two regulators-composed businesses: Freddie Mac computer and you can Fannie mae. Basically, it frees right up money having finance companies so they are able continue steadily to bring mortgage loans. Antique funds need certainly to follow, or comply with elements place by the Freddie Mac installment loans for bad credit Columbus and Fannie Mae.

The differences Between a conventional Loan versus FHA Financing

.png)

FHA money tend to be more high priced. He’s significantly more charges and you can expenses associated with him or her than simply an effective traditional financing.

When you need to pick good fixer-higher, you might have to believe a normal financing. FHA financing needs a safety and health assessment with a high criteria which can be tough to fulfill.

You will additionally must envision a traditional loan while you are deciding on a residential property or second domestic. FHA mortgage loans are only for purchasing a first house.

Antique finance was risker to own a loan provider since they are maybe not secured by the government. For those who default toward mortgage, the lending company may be out of wallet for their currency. Due to this, they are more difficult so you’re able to meet the requirements to track down.

FHA compared to Antique Financial getting a purchaser

There are various a few whenever debating between a keen FHA otherwise traditional mortgage. Your credit rating and you will loans-to-earnings ratio, the degree of your own advance payment, therefore the size of the mortgage are circumstances when deciding on a loan.

Credit score for FHA and Antique Fund

Irrespective of and this mortgage your make an application for debt life is gonna are categorized as an excellent microscope. Starting with your credit score.

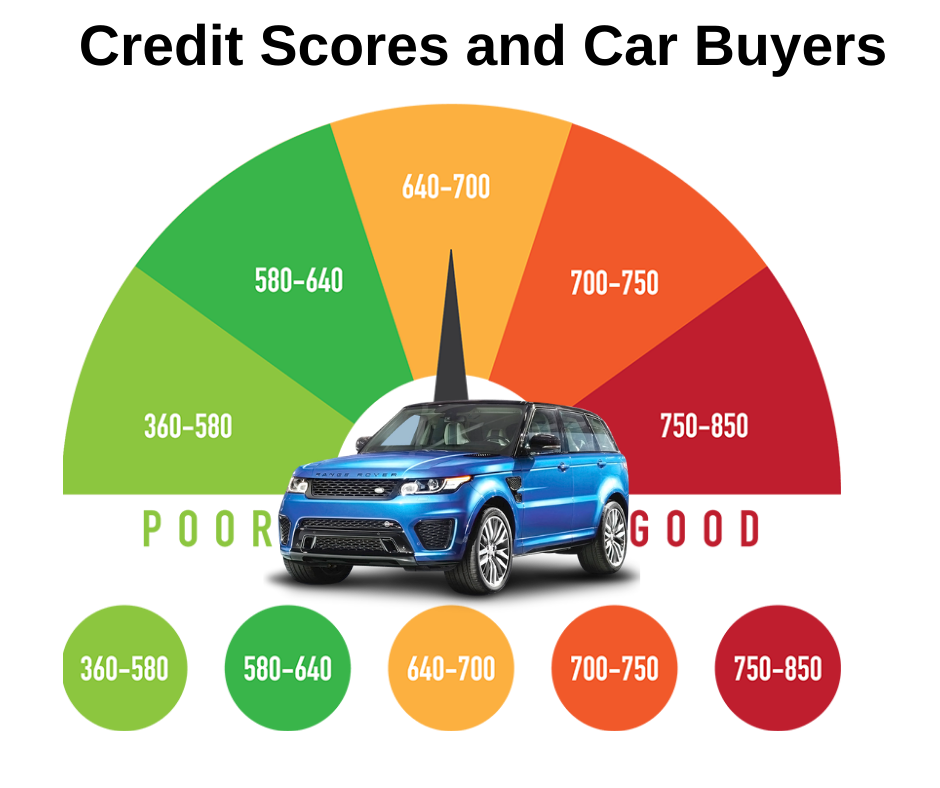

A credit history otherwise FICO Rating was a about three-thumb count based on your credit report, produced by the newest Fair Isaac Organization inside the 1956. They means exactly how high-risk you could otherwise might not be to a lender. The financing get directory of three hundred-579 categorize you as a poor exposure, if you are a rating out of 800+ is a fantastic risk.

Antique loan costs versus FHA prices have decided by these ratings and you may recommendations entirely on the credit reports. It take into consideration the duration of your credit report, what kind of borrowing you have, the manner in which you make use of borrowing, as well as how many new membership you’ve got.